When you add up the damage done by the coronavirus, it stretches beyond infecting U.S. residents. Now grain farmers are starting to feel the impact as the Chinese export market dries up under the pressures of Covid-19. In order to reduce feed costs, Chinese farmers are culling some of their livestock. Fewer animals means a reduced export order and we all know what that leads to.

Beyond China, the result is nearly the same across the world, as the U.S. Department of Agriculture reports. “Prices for all U.S. wheat classes were down during the month of February,” the report stated, “pressured by competitor prices and losses in other markets related to the widening spread of COVID-19.”

Thanks to the virus, a once growing export market is now shaky. As a result, it’s back to the drawing board for grain farmers. Sure, you can put your crop into long-term storage, but that’s not a permanent solution. Eventually you’ll need to find a buyer before the grain spoils.

This is a more challenging problem than the issue facing most households. When we talk about the virus’s impact elsewhere, it’s contained to infection rates. As the virus dies down, businesses will reopen and hire staff members thanks in part to financial help from the federal government.

But in this situation, you’re dealing with multiple countries, all of which responded to the virus in different ways. With that in mind, should we expect this year’s grain market to rebound? That question has a complicated answer.

What’s Causing the Drop in Demand?

If you want to know why grain prices are dropping, you have to look to China. In a market that’s already dealt with African Swine Fever and a trade war over the last 12 months, the coronavirus hit hard. U.S. Agriculture officials point out that in addition to the obvious restrictions, such as people missing work, the virus is damaging the main export revenue stream for American grain: livestock feed.

“Poultry is being hit the hardest in the first quarter, as a result of the closure of the live bird market in China since the outbreak of the virus,” said Rabobank grain and oilseeds analyst, Lief Chiang. In an interview with Feed Navigator, Chiang explained that due to the virus, the Chinese livestock industry was seeing discouraging margins and weak demand. When money got scarce, these farmers did what anyone would do and they started cutting costs.

“We have observed that many small and medium-scale poultry farms are lowering their daily [ration amounts] and even culling chickens to reduce feed costs,” Chiang said. “Aside from this, the virus spread is also delaying China’s planned hog herd rebuilding.”

As Chinese farmers looked to rebuild their herds after first Swine Flu and then Swine Fever outbreaks, they turned to U.S. farmers for grain to use as livestock feed. But those plans have been put on hold along with any feed orders, Chiang said, suspended due to the coronavirus. Quarantined farms have reduced herds and in turn, reduced their needs.

Coronavirus Shuts Down Export Promotion

The first quarter of 2020 was supposed to be a growth period for grain exports, especially soybeans. That was due in part to grain promotion activities, where groups like the U.S. Grain Council went to Chinese, Japanese and Korean farms and businesses, basically acting as salesmen. All currently planned trips have been put on hold, however.

“We have postponed programs in China and Southeast Asia and canceled international travel to affected areas,” U.S. Grains Council Director of Communications Bryan Jernigan told Milling & Baking News.

The same goes for U.S. Wheat Associates, which has postponed two delegation visits to Asian nations. USA Rice also canceled planned meetings and the Food and Beverage Asia exhibition postponed all events, which had been scheduled for April.

Prepare for Long-Term Storage

With all this in mind, it’s highly unlikely you’ll be able to sell that grain crop in the next few weeks. After all, prices won’t suddenly increase. Across the U.S., soybeans are selling for less than $9 a bushel. To put it in context, that’s lower than the $9.14 average during last year’s trade war with China.

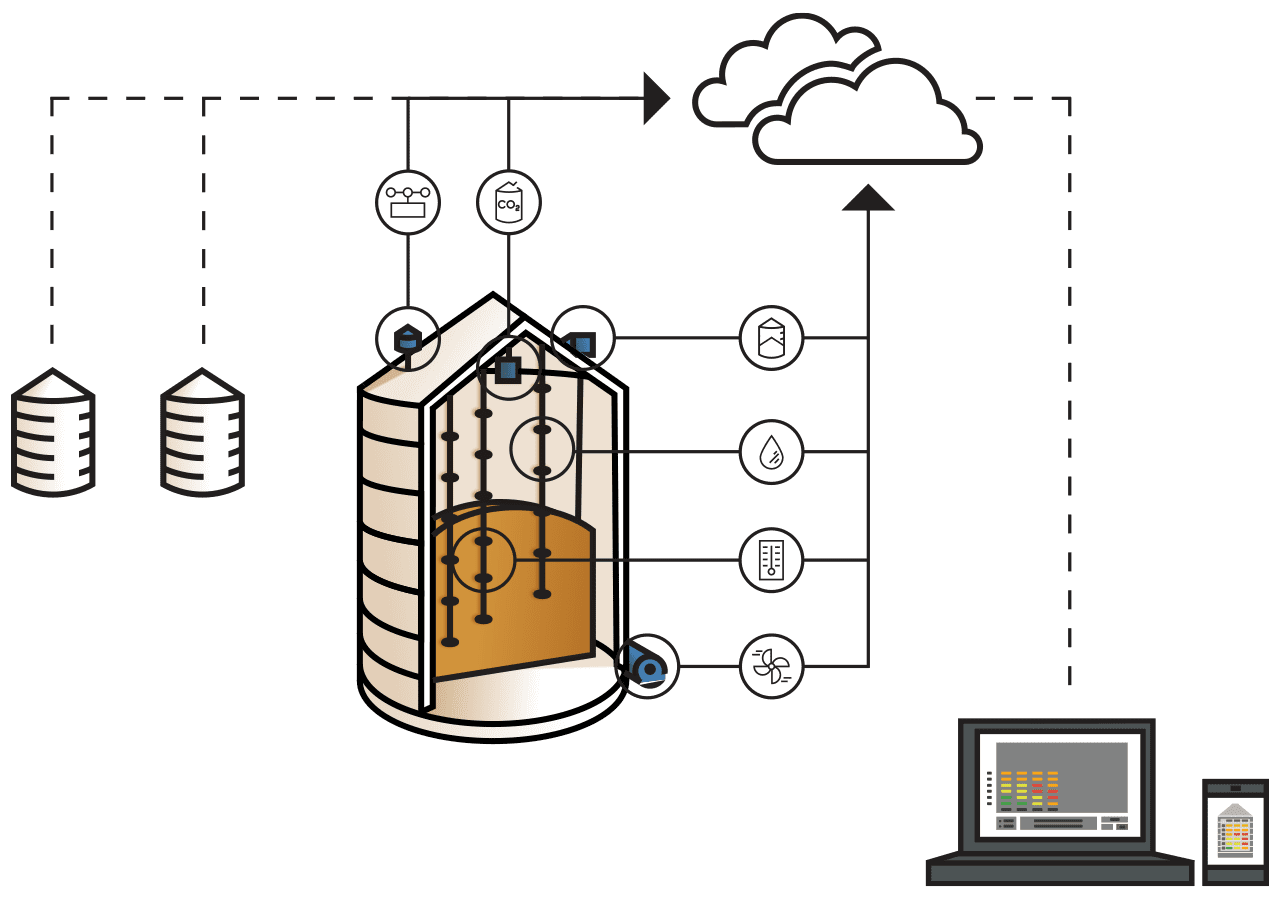

In fact, even after the coronavirus outbreak dies down, U.S. officials say to expect a tepid rebound of around 2 percent growth for the market this year. After all, Chinese farmers will need months to rebuild herds and funds. That means longer storage times, unless you want to sell at a greatly reduced price. It also means you’ll need to monitor grain temperature and bin equipment to avoid crop damage.

For advice about expanding your grain storage and dialing in your grain temperature monitoring system, you can call us at 1-800-438-8367, contact us here or live chat to get the information you need to make the right decision for you.