In a recent podcast of AgriTalk, host Chip Flory checked in with Dan Basse from AgResource Company on the current and future state of the global corn market. According to Basse, demand has been the driving force behind fall corn prices and the future looks even brighter.

As we end what has been a tumultuous year in agriculture, four-dollar corn has become the new normal. And early assessments predict prices could reach as high as five dollars. Even better, these incredible corn prices are said to stay for at least the next two years. According to Basse, this rapid shift in the corn market is incomparable to anything he’s seen.

“If I look back in my 40 years of being in this business. This happened so quickly in terms of loss of U.S. crop and world crop loss and the arrival of a big buyer, that it’s almost unprecedented,” says Basse on AgriTalk. He continues, “I’ve been saying that I’ve never seen anything like this, and when you get the combination of the lower supplies and the higher demand, it’s a rare combination.”

It is this low-supply and high-demand that Basse says will fuel the corn market over the next few years.

China’s Need for Feed Created Higher Corn Prices

The USDA estimated that China would need 13.5 million metric tons of corn. However, Chinese demand is already at 20 million metric tons according to Basse. And he sees it climbing even higher to 25 or 30 million metric tons. If that happens the United States would have an export demand of 3 billion bushels. This number might seem outrageous but as Basse states:

“It just speaks to where we are today, and that we really need to have big crops in South America and North America for at least two or three growing seasons.”

This increased demand boils down to one sizable need, and that is feed. Specifically, it’s China’s increased need for feed. According to Basse, current data showed an exponential increase in Chinese feed usage in September and October. An additional record-high use was expected to be confirmed for November as well. So, what happened? For Basse, the answer is a simple one.

“When you look back, and I think USDA data proves this, that the Chinese hog production number fell 11.3%. But their feed usage last year was only down 3.7% because there’s no longer the backyard hogs. And we’re not seeing the table scraps feeding. They’re getting more corn and soy meal pushed into these factory, bio-secure farms that are just ramping up production to levels we never expected. So, to me, it’s the big structural change in terms of what’s happening with China’s pork industry.”

Higher Corn Prices Will Continue into the New Year and Beyond

As China’s hog production increases and they refine their production practices their corn needs will persist. China has changed their hog production tactics and are now using multilevel buildings in lieu of farmland. This new way of doing things is what has and will continue to drive higher corn prices.

According to Basse, “If they get those westernized diets, somewhere between two to two and a half years out, their ability to produce pork will kind of ramp-up to levels that will stabilize.” He continued, “we see runway here for an ag bull market that’s maybe 18 to 24 months, and it’s a demand market.”

Essentially, farmers can expect these higher corn prices to endure for at least one to two years. China’s need alone will keep corn prices above the four-dollar mark, with average prices between roughly $4.05 and $4.50 a bushel. Potential complications and limitations with crops down south could increase U.S. corn prices even more.

Looking to South America – Corn Prices Could Soar

China’s demand is the driver, but the supply may continue to fuel the market. Weather concerns in South America have Basse and his firm lowering their production projections for this continent. As he tells it, “Right now, we see support in the corn market like its $4.05, and if you give me a problem in Argentina or with the Safrinha crop in Brazil, we can be talking corn prices making it up to $4.80 to $5 sometime late winter, early spring.”

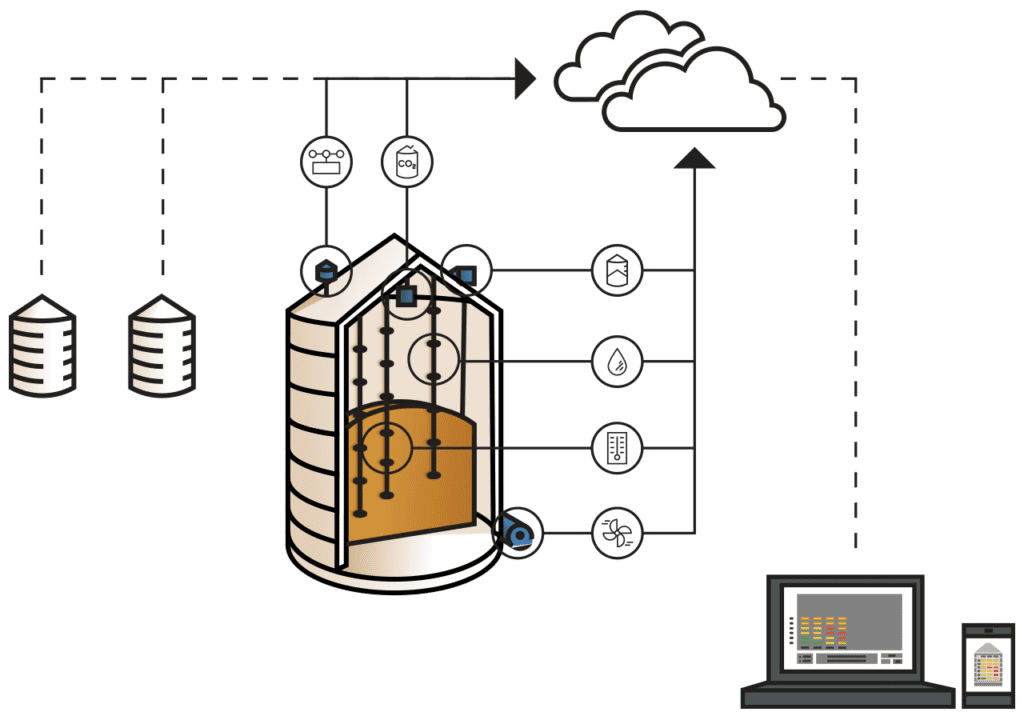

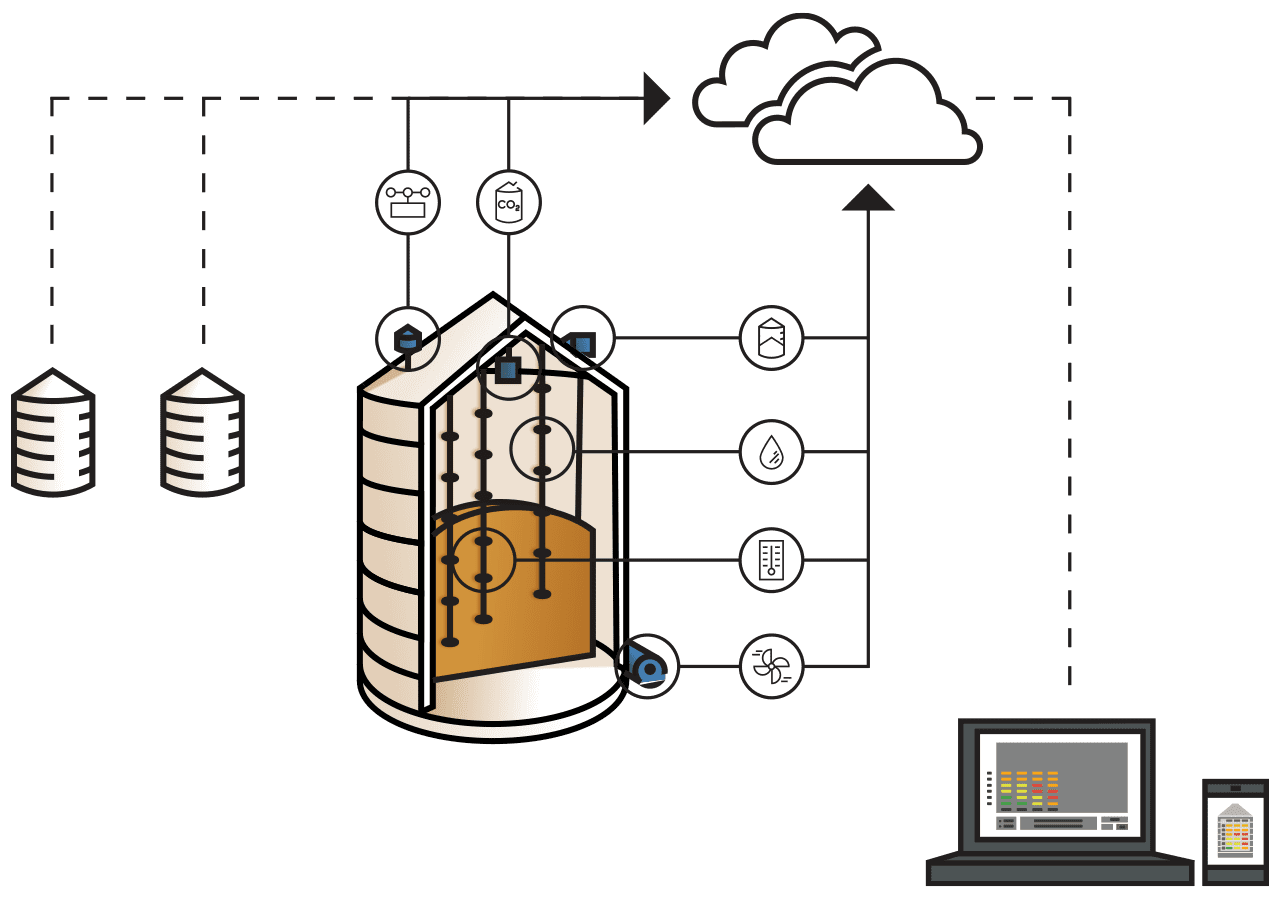

China’s need mixed with South America’s low production projections could put U.S. farmers in an advantageous position. Farmers in the best position are those who have held onto their corn supply waiting for the market to improve. Now, the market has arrived and their patience will be rewarded. It’s moments like these that illuminate the importance of proper grain storage and the benefits of grain temperature monitoring systems.

Ask us about grain storage advice here, live chat with us here, or call us at 1 800 438 8367.

Follow us on Facebook where we discuss a variety of farming topics, including grain markets, grain temperature monitoring and Smart Farming.