As January 2021 comes to an end, farmers have approximately seven weeks left to sign up for two essential farm programs. An unusually short deadline was given to register for either Agriculture Risk Coverage (ARC) or Price Loss Coverage (PLC).

Farmers have until March 15th to contact their local Farm Service Agency office to make their election for the year. This is required even if there are no changes being made. If farmers miss enrollment for this crop year, they’ll be ineligible for payments.

Although enrollment has been open in both programs since October by the end of 2020 only 10% of producers had made an election. With the COVID pandemic making an election won’t be as easy as in previous years. Farmers can’t just drive over to their local FSA office and get helped by staff. They’ll need to either signup online or via email, the latter is the most popular approach.

The best thing for producers to do is call their local FSA office to speak with a staffer. Once the call is concluded they will be emailed the necessary forms to fill out. Farmers will need to print out the forms, sign them, scan the signed copies, and email them back to the office. Technical issues can arise so producers will want to plan ahead.

Farm Bill Changes Give More Leeway to Farmers

Back in 2018, the Farm Bill was changed to provide farmers with more leeway and fewer constrictions. Previously, farmers could only choose between ARC and PLC once every four years. Meaning, they made their election and then were stuck with their choice for the next four years.

Changes were made to the Farm Bill where farmers were able to make their election one-time with a two-year commitment. Now, in 2021 farmers are able to choose an election each year until 2023. This gives them room for error. If they end up with the wrong coverage plan, they can easily change it in the following year.

Farmers need to understand how these two coverage programs are implemented in order to make the right decision. According to the USDA website “the PLC program payments are issued when the effective price of a covered commodity is less than the respective price for that commodity.” In contrast, the ARC program gives coverage for losses in revenue at the county level. ARC payments “are issued when the actual county crop revenue of a covered commodity is less than the ARC guaranteed for the covered commodity.”

To determine the best choice for their individual farms, producers need to make calculations for both programs. This is based on their farm’s number of farm yields, ARC yields, and base acres.

Crop Insurance Specialists Can Help Farmers Make the Right Choice

For farmers who are struggling with choosing between PLC and ARC, there are crop insurance specialists who can help. GreenStone Farm Credit Service is one such company offering crop insurance guidance. Their specialists run the numbers and project which program is the best choice for each individual farm. These numbers are based on anticipated prices and past projections allowing them to make the best decision.

Additionally, Kansas State University provides a calculator and a “how-to” video to help farmers determine the best option for their farm. These tools can be applied to any county in all fifty states.

Even more, Iowa State University is offering a series of webinars that begin on February 5, 2021. Designed specifically for Iowa farmers, this series is intended to help make the best Farm Bill decisions for this year.

If farmers are still feeling unsure about which program to choose, we recommend contacting your crop insurance provider. They can do the calculations and determine the best solution for any farm.

At a Glance – Agriculture Risk Coverage vs Price Loss Coverage

According to a decision-making spreadsheet provided by Kansas State University ARC usually pays better in low-yield situations. Alternatively, PLC usually pays better in low-price situations. Agriculture Risk Coverage and Price Loss Coverage programs offer farmers financial protections against considerable drops in revenue or crop prices. They are essential safety nets for the majority of American farms.

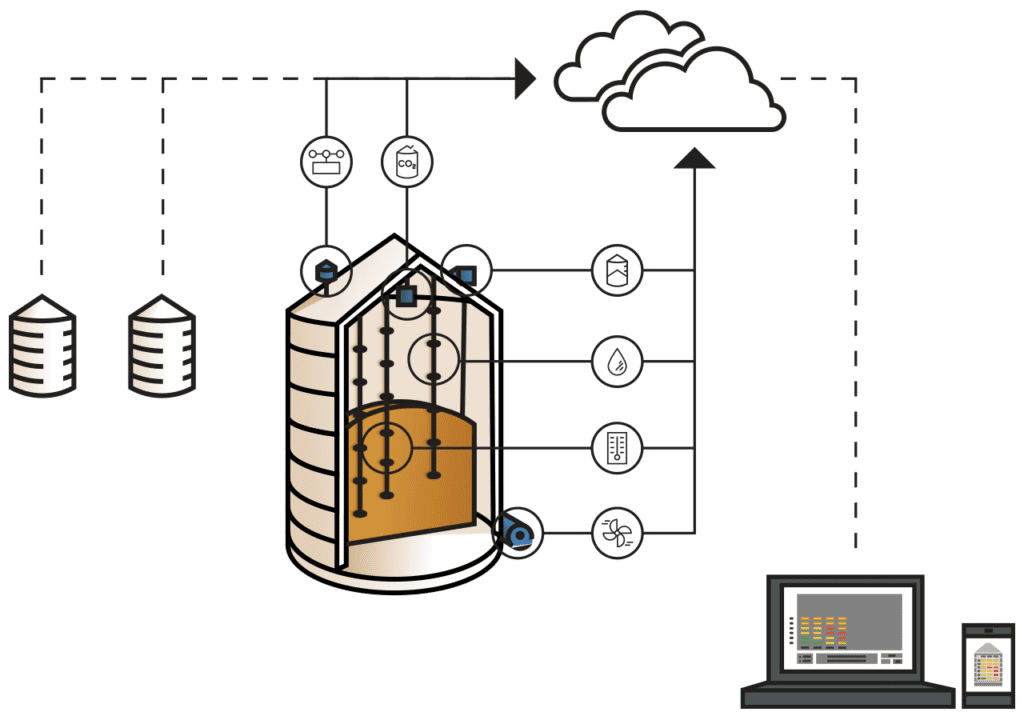

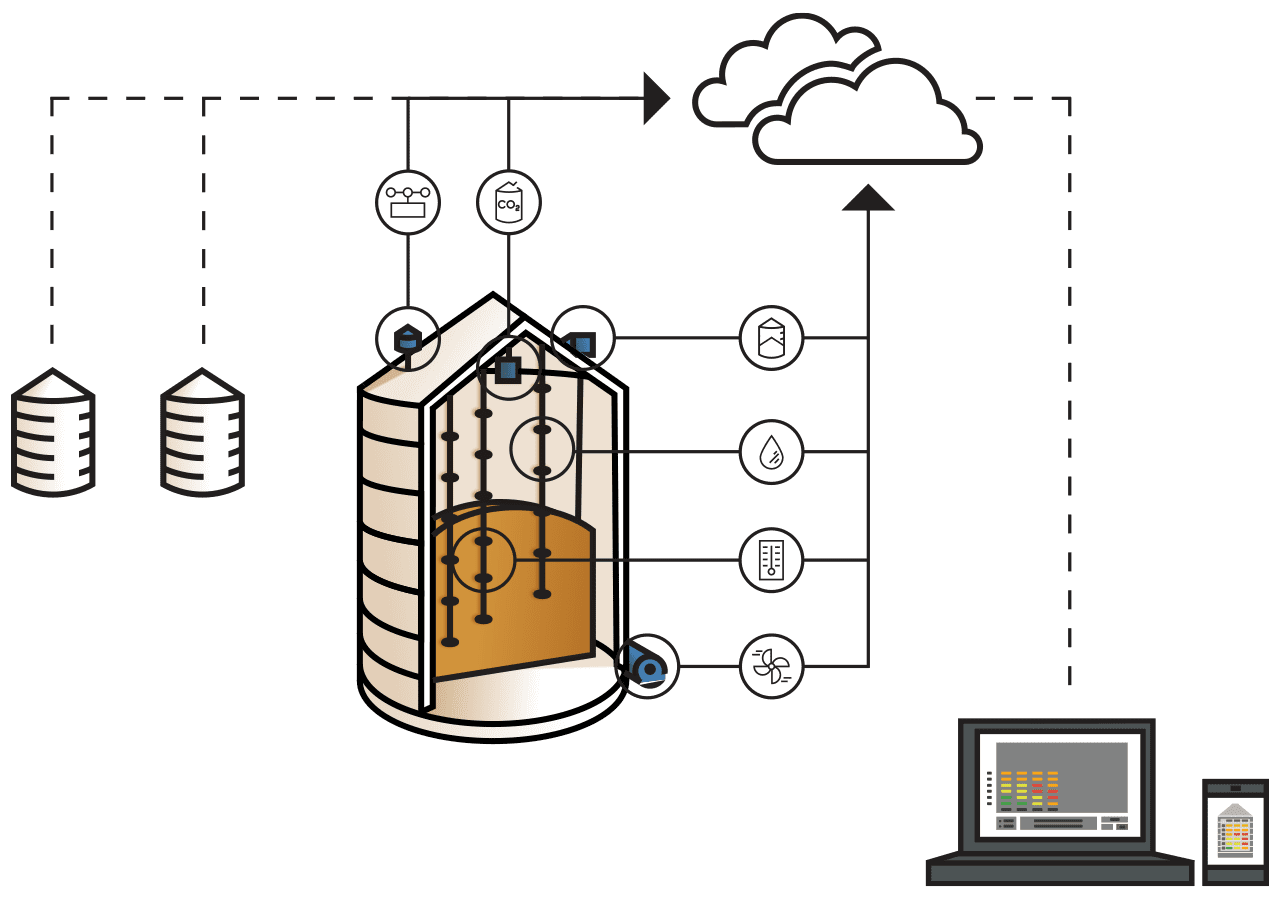

Ask us about our remote grain monitoring systems, live chat with us here, or call us at 1 800 438 8367.

Follow us on Facebook where we discuss a variety of farming topics, including farm insurance, grain temperature monitoring, and Smart Farming.