Who will buy our soybeans? Normally, US farmers don’t have to search hard to find the answer to that question. Over the last decade, multiple international buyers came forward, with more than 50.1 million metric tons shipped out to 10 countries in 2018 alone. But in 2019, farmers find themselves looking for options, as grain exports are down 22 percent to just 39.2 million metric tons sold overseas.

For many, that means planning for long term storage, in hopes that prices increase and more markets open. In some cases that’s already happening, with the European Union, South Korea, Taiwan, and Japan increasing their orders. But is it enough to balance out losses from other customers? Also, what’s the best method to plan for the future in this situation?

Let’s take a closer look.

Grain Exports Take a Hit in 2019

The biggest hit for this year’s grain exports comes from China. In 2018, U.S. farmers shipped 25.1 million metric tons of soybeans to China, but less than 12 months later that number has dropped 58 percent. Yes, there are talks of tariffs and ongoing trade negotiations, but beyond politics, there’s a simple reason for the reduction. Basically, the country has fewer pigs to feed. Soybeans are used as animal feed in China and over the last year, an outbreak of African swine flu has cut the pig population in half.

But while the market has dropped in China, grain exports are on the rise in other countries. Speaking recently to a group of farmers, U.S. Department of Agriculture Secretary Sonny Perdue said the soybean industry had become too dependent on China and needed to develop other markets, singling out India, Indonesia, Malaysia and Thailand as examples. While those markets haven’t opened up yet, others have.

The European Union, for example, went from buying 4.5 million metric tons of soybeans in 2018 to 6.5 million this year. Mexico also purchased more, going from 3.6 million to 4.2 million to help their growing hog population. The biggest increase came from Argentina, which on its own is the world’s third largest soybean producer. But after experiencing a drought-plagued crop, the country purchased 1.875 million tons of US soybeans this year, 1319 percent above the 2018 level.

Forecasters Predict Growth for 2020

As the US explores more markets beyond China, agricultural forecasters predict soybean exports to increase in 2020. The report from the USDA’s Economic Research Service tells farmers to expect both an increase in the quantity of soybeans shipped and the price they’ll get for the crop.

“Soybean exports are forecast to rise $400 million to $16.8 billion on higher volumes,” the report says.

Even if the trade negotiations end with China next year, USDA forecasters don’t expect a significant increase in soybean exports, due to the ongoing swine flu. Instead, they’re looking at other parts of the globe. As we mentioned before, hog farming is on the rise in Mexico, so farmers in that country need soybeans to feed their animals. A new trade deal with the European Union means more soybean shipments heading that way, and the USDA expects trade to continue to grow with Indonesia, as more than 265 million people in that country eat tempeh and other soy-based products.

Should You Plan to Store Grain Long-term?

While today’s market is sluggish, the future does look brighter. But that means if you want to bet on higher prices, you’ll need to store your crop for months, rather than weeks. We know that’s a risk to take, especially as farm expenses continue to rise across the country. But there are ways to help manage both the financial and physical risk to your crop.

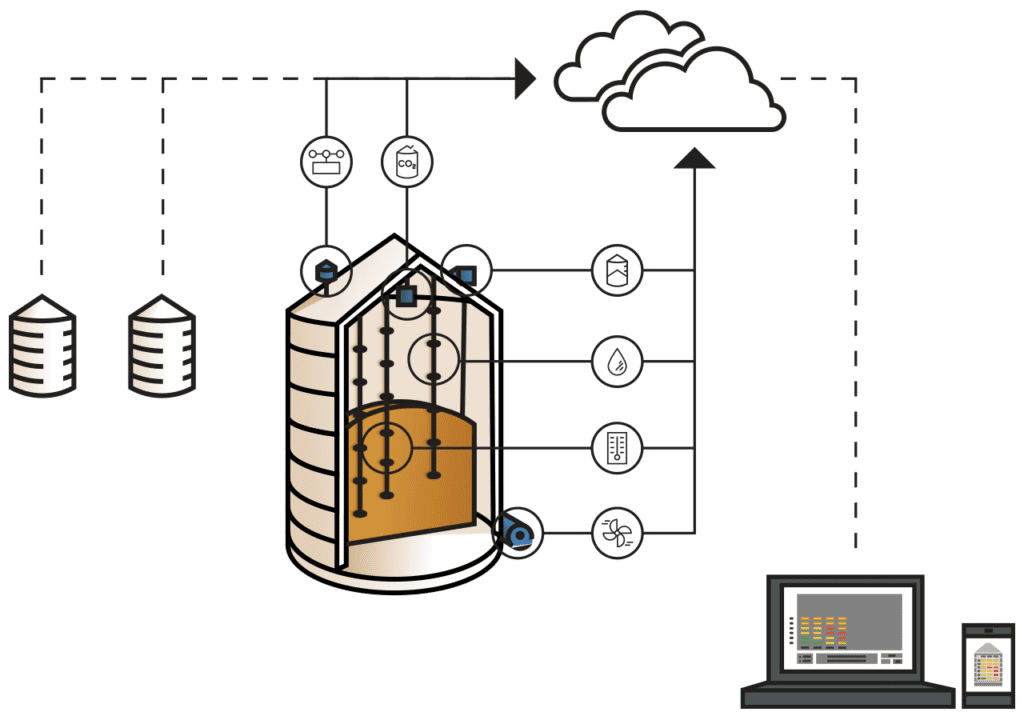

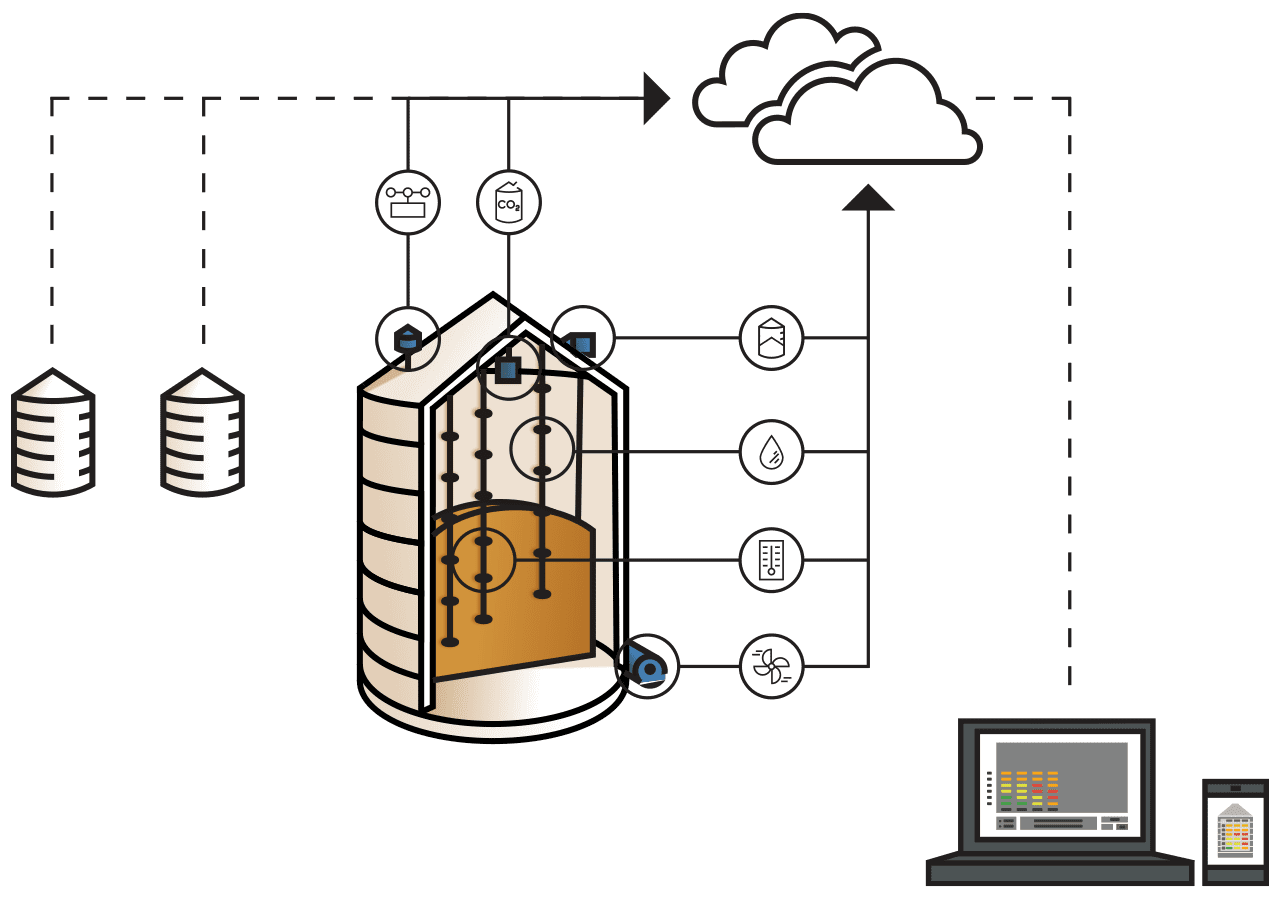

In order to maintain the quality of the crop for long-term storage, we have to pay close attention to grain moisture and air temperature. Now, you can’t improve the quality of your grain after the harvest. But you can protect it from deteriorating in storage by monitoring the temperature. If the air temperature isn’t controlled, moisture can build up and cause the grain to spoil.

How does temperature monitoring help? Let’s say you bring in a harvest this year with 17 percent moisture content. According to the USDA data, you could store that corn at 80 degrees for an estimated 27 days. That means you need to find a buyer for your grain exports within a month, before fungus or mold sets in.

Now let’s take that same corn but lower the air temperature in the silo to 40 degrees. With nothing but the change in temperature, that corn can be stored for approximately 282 days. You now have more than nine months to sell the product.

Stored Grain and Temperature Monitoring

There are a number of ways to help control grain temperature in your silos. You can do it remotely or by using portable technology.

For more information about grain exports and grain temperature monitoring, call us at 1-800-438-8367, contact us here or live chat to ask about the right grain monitoring system for your farm.