If there is one thing farmers know, it is to expect the unexpected. So much of farming has historically been out of farmers’ control that agriculture may be the single most adaptable industry in the U.S. From weather events to world politics, the most consistent aspect of farming is change. On top of an ongoing drought, the war on Ukraine is the next big disrupter to U.S. agriculture. Farmers are already feeling the fallout of the invasion of Ukraine, particularly how the war affects grain markets.

The Cost of Doing Business

One of the biggest problems facing American farmers this year is the price and availability of fertilizer. Russia is the second biggest producer of fertilizer components, or soil nutrients. Due to limited supply, farmers are paying up to three, maybe even four, times what they paid last year for the same products.

Agricultural supply stores are rationing not only fertilizers, but herbicides. A farmer with a 1000-gallon order of Roundup, for example, may only get a small fraction of that amount. Retailers are trying to make sure every farmer gets some, and availability is unpredictable. So, it’s not just price farmers have to worry about, but also availability.

Farmers who planned to plant corn or wheat this spring are now considering shifting to soybeans, since that crop requires less fertilizer. With Ukraine likely unable to fulfill its expectation as one of the top producers of wheat in the world, a pivot away from wheat in the U.S. will only exacerbate worldwide shortages.

Not Just Fertilizers, but Fuel Price Increases Too

Maybe an even bigger problem at this point is an increase in fuel prices – another way the war affects grain markets. It raises the costs of planting, raises the costs of fertilizers – especially nitrogen, and even affects transportation and labor costs. Since the U.S. won’t be importing any products from Russia, a major exporter of fuel and fertilizers, costs may continue to rise.

Energy prices were already on the rise before the war and took off with word of the invasion. U.S. Agriculture Secretary Tom Vilsack has warned companies against artificially raising prices above supply and demand to line shareholders pockets while farmers are struggling.

No Pot of Gold at the End of the Rainbow

With Ukraine being the fourth biggest producer of wheat in the world and being unlikely to produce and export much, if any, wheat this harvest season, U.S. farmers can expect to sell high. Unfortunately, almost 80% of U.S. 2021 wheat crops were sold prior to whispers of war, so there’s no ready supply to take advantage of the price increases. Additionally, the high cost of inputs will likely wipe out any profits from next year’s crops.

Another problem keeping farmers from taking advantage of higher wheat prices is being in the middle of a drought. Farmers already anticipate lower yields due to drought conditions. When you factor in the high cost and low supply of fertilizers and herbicides, potential yields look even bleaker. So, at a time when farmers could get the highest prices for their wheat, they struggle with the conditions to produce it.

What to Expect When War Affects Grain Markets

As the war continues, one can expect prices on everything to go up. Higher fuel will make producing grain and delivering all foods more costly. The ingredients used to make food products will also be more expensive. This is especially true for wheat, corn, and soybean-based products like cooking oils, breads, and tofu.

But there is another market that can’t be forgotten, and that is livestock feed. The increased cost of corn and soybean production will in turn increase the cost of animal feed. All these costs, from tofu to meat prices, will be passed onto consumers.

Consumers will react by changing their buying behaviors. Some will replace wheat with rice. They’ll eat less meat. They’ll drive less. These behaviors will blow back on farmers who will be unable to profit from their efforts. In simple terms, everything is going to cost as much as the market will bear, which may not be enough for farmers caught in the middle.

How war affects grain markets and consumer prices in general is far-reaching. Gas prices will affect trucking expansion, which will continue to squeeze supply chains. High gas prices also affect the labor market with people opting to work close to home or from home.

Create the Best Options for Marketing Your Grain

In the end, farmers’ biggest worry is production costs, which most anticipate will be at least 20% higher than last year. Their fear is that anticipated higher prices won’t cover the gap.

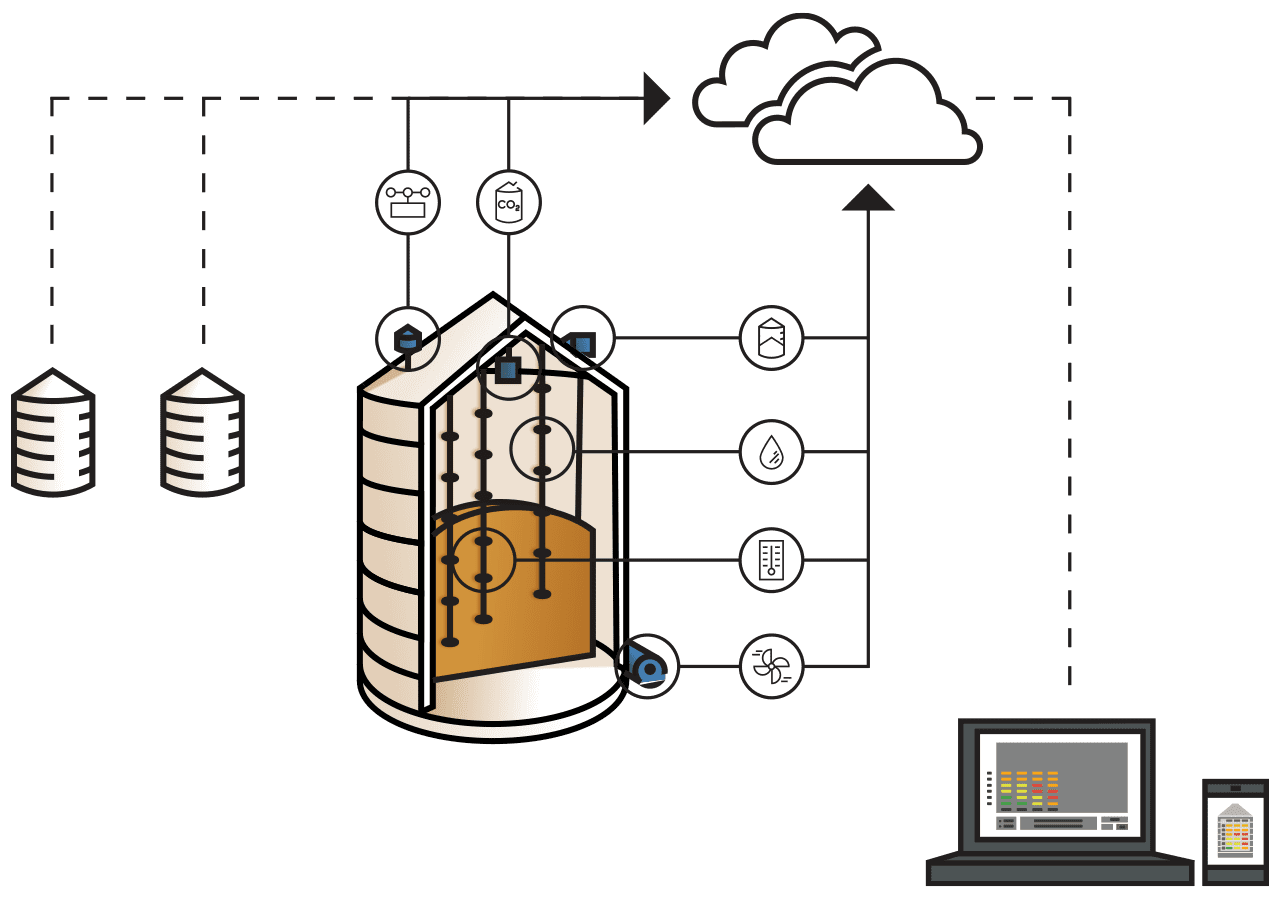

Grain storage plays a crucial role in marketing your grain. When you sell is often as important as what you bring to market. (Imagine wheat farmers cashing in right now instead of last fall.) Timing matters. Grain condition matters. We can help you get the most money for your stored grain.

Ask us how we can help you here. If you prefer live chat then click here, or call us at 1 800 438 8367.

Follow us on Facebook where we discuss farming topics such as grain temperature monitoring and Smart Farming.